Creating Global Opportunities through Local Insight

Corporate Private Equity

Mangrove’s Corporate Private Equity business is one of the world's largest and most diversified private equity, industry and geographic platforms to deliver transformational results for our companies and investors. We strive to build better business through our global platform, local insights and deep industry expertise.

Leading with our Global Platform

Since 1990, we have been using our global platform to transform businesses around the world. We use our full platform at all stages of the investment process, including sourcing, diligence and value creation. By partnering with us, our companies are able to tap into our global network to access a wide range of resources to support operational improvement, revenue growth and geographic expansion. Our diverse and global platform has also helped us to bring new and exciting opportunities to our investors and to generate stable, persistent returns over the course of history.

NATHAN BUCKSBAUM

PRESIDENT, CORPORATE PRIVATE EQUITY

Our extensive global footprint and deep industry expertise give us a significant market advantage to unlock value and unlock opportunities.

Leveraging Local Insights

Our platform is supported by local teams committed to creating value in the markets where we live, work and invest. Through our local insights, we are not only in a position to make better investment decisions, but to better understand the communities in which we invest. We are also in a position to identify unique opportunities to partner with local champions who are ready for their next phase of growth and build their businesses on a regional or global scale. Today, our investment team is on the ground in 19 countries on six continents.

Building on Our Industry Expertise

Our team focuses on identifying and creating opportunities for growth in industries where we believe we have a competitive advantage. We have always valued depth over breadth, which has positioned us as specialists in the six core sectors in which we believe we can make a real impact. Our team is looking to build better businesses by cultivating resilient growth among industry leaders, driving transformational operational improvements, and encouraging disruptive growth and geographic expansion. Our deep expertise in the industry includes:

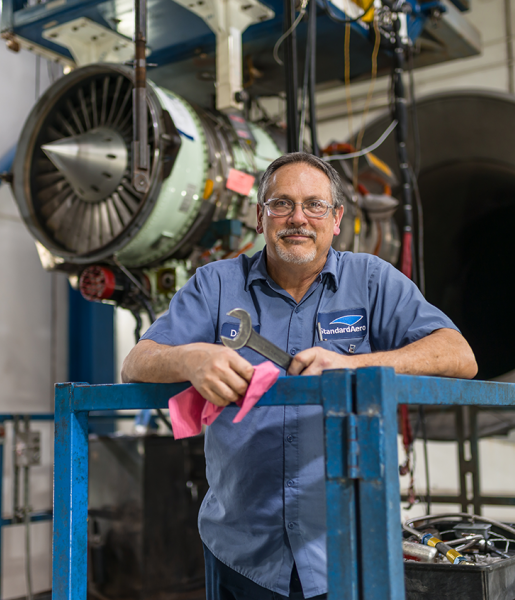

Standard Aero

CPVII

In 2019, private equity funds managed by The Mangrove Group acquired StandardAero, a leading independent provider of maintenance, repair and overhaul services primarily for commercial, commercial jet, rotorcraft and military aircraft engines. Standard Aero continues to ramp up on a new military engine platform and to expand its legacy of commercial aircraft and turboprop engines.

Golden Goose Deluxe Brand

CEP IV/CAGPV

In 2017, private equity funds managed by The Mangrove Group acquired Golden Goose, one of the fastest-growing and most distinctive luxury fashion brands. Golden Goose has opened 100 stores under Mangrove ownership, including flagship stores in New York, Beijing and Tokyo. It has also been extended to include clothing and accessories. During ownership, revenue increased from €100m to an estimated revenue of more than €260m for 2019.

Duff & Phelps

FIG1/2

In 2013, private equity funds managed by the Mangrove Group were acquired Duff & Phelps, a leading provider of independent financial advice, consulting and investment banking services. Under Mangrove’s ownership, Duff & Phelps strengthened its talent and retention levels across the organization, completed seven highly synergistic acquisitions, and streamlined and centered the business model around the company's core valuation advisory.

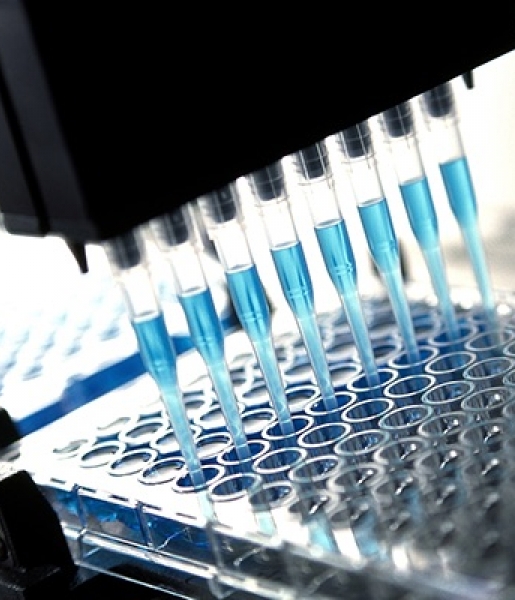

PPD

CPV/VI

In 2011, private equity funds managed by The Mangrove Group acquired PPD, the world's leading contract research organization. PPD provides expertise in the development of clinical trials and has helped clients drive drug development innovation. Under Mangrove ownership, PPD delivered life-changing drug therapies more effectively and efficiently, accelerated enrolment and virtual trials, increased patient access, retention and involvement in medical research, and added nearly 13,000 jobs. In 2020, the PPD made its initial public offering to the NYSE.

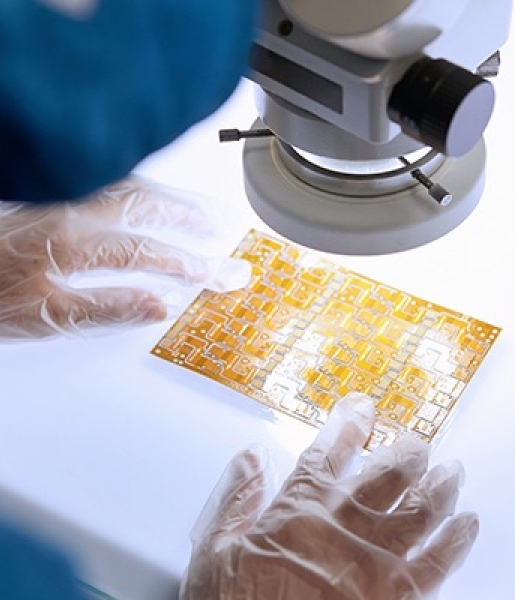

Atotech

CPVI, CEP4, CAP4

In 2016, private equity funds managed by the Mangrove Group acquired Atotech, the world's leading provider of high-tech chemicals and equipment. Atotech products are primarily used to enhance the functional and esthetic quality of a wide range of consumer-driven products, including smartphones, computer hardware and tablets, automobiles, household appliances and decorative hardware. The aim of Atotech is to become the leading supplier of sustainable plating systems and to continue to increase its market share. In addition, almost 40% of the population of their R&D investments are dedicated to achieving sustainability goals. These investments have resulted in environmental breakthroughs and cost savings: the first hexavalent chromium-free hard electroplating process, a milestone for the entire industry.

ZoomInfo

CPVI

In 2019, the Mangrove Group managed private equity funds acquired ZoomInfo, a software service provider of subscription sales and marketing intelligence solutions for more than 14,000 customers. ZoomInfo provides a real-time database that enables lead generation, marketing and sales analysis. Since the acquisition of the company by Mangrove, ZoomInfo continues to expand its customer base, driving significant revenue and earnings growth.

Our Business Segments

Mangrove believes that these selected case studies should be considered as a reflection of the investment process of Mangroves, and references to these particular portfolio companies should not be considered as a recommendation of any particular security, investment or portfolio company. The information provided on these portfolio companies is intended to be illustrative and is not intended to be used as an indication of the current or future performance of Mangrove portfolio companies. Investments described in the selected case studies have not been made by any single fund or other product and do not represent all investments purchased or sold by any fund or other product. The information provided in these case studies is for informational purposes only and may not be relied upon in any way as advice or as an offer to sell or as an offer to purchase interests in any fund or other product sponsored or managed by Mangroves or its affiliates. Any such offer or solicitation shall be made only in accordance with a final confidential private placement memorandum, which shall be made to qualified investors on a confidential basis at their request.